U.S. employment is trending in the right direction as shown by the fall in the unemployment rate in the graph on the left. Business conditions continue upward. The graph on the right shows business survey trends are positive in both the manufacturing and non-manufacturing areas. It is a good sign when the ISM indices are above 50.

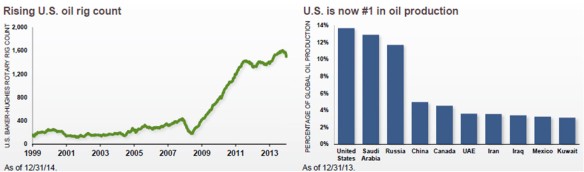

The price of oil has dropped radically over the last seven months from $105 to $48 per barrel. This is partially a consequence of the huge increase in U.S. drilling rigs coming online over the last few years. The graphs below show the trend in drilling rigs and the U.S. share of global oil markets. The Saudis are allowing the price to drop by not cutting back their own oil production. Some speculate that the Saudis are trying to drive the marginal U.S. oil producers out of the market. Certainly, over time, U.S. and global energy firms will cut back on production and the price will stabilize. In the meantime, the drop in gasoline price is like a huge tax cut for U.S. consumers and should stimulate the economy.

The U.S. dollar has also increased in value relative to other currencies. The Euro has dropped from 1.39 to 1.06 over the last 10 months. America has the strongest economy at the moment. A strong dollar means lower inflation and lower cost imports for U.S. consumers but it will reduce demand for our exports. However, exports make a relatively small part of the U.S. economy. Europe continues to struggle with stagnant economies and the potential for an exit of Greece from the Euro. The Chinese economy is still growing but at a slower rate. They have a huge over-building problem in their property market. The slowing Chinese economy means lower demand for exports from the commodity producing economies of Asia, South America and Africa. The squeeze on Russia due to a lower oil price and sanctions from the West due to Russia’s actions in Ukraine may lead to further instability.

Although the U.S. Federal Reserve is likely to begin raising interest rates to try to normalize credit markets, they will do this slowly in light of the fragile global economy. Inflation is low and the Fed does not feel a need to tighten credit conditions significantly when the economy is not overheating.

The U.S. economy continues to improve.